What is an endowment? How do endowments help foundations provide ongoing annual financial support to address charitable causes?

Time:

30 Minutes

Materials:

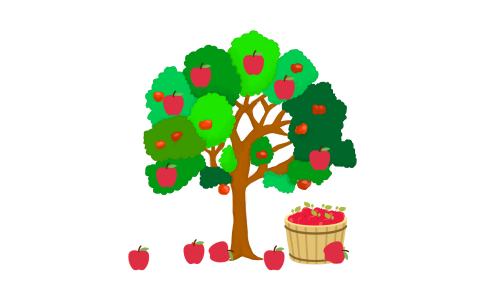

- Image of the apple tree

Activity:

- Tell the youth grantmakers that one source of the dollars they are able to gift comes from an invested fund called an endowment.

- Explain how an endowment produces interest and grows fund dollars for the foundation. If possible, explain the source of the foundation's original endowment account.

- Summary: Foundations use their funds to award grants to nonprofits. Some of their funds are saved in the form of an endowment. An endowment is a pool of money that is invested to earn interest and grow in value forever. Foundations use only a percentage of the interest so the account continues to grow and earn more interest. The original invested amount stays safe in the bank and is never spent.

- In this analogy, an endowment is like an apple tree.

- The trunk of the tree represents the base endowment fund. It is steady and remains rooted and strong for many years. The foundation invests a large amount of money in a solid financial account, which is like planting the tree solidly and committing to keeping it there.

- The apples that grow each year represent the interest that is gained each year from the investment of the endowment funds. Each year grantors can pick the apples and give them away without affecting the trunk and branches. This is like granting out the interest from the endowment to the community. The trunk and branches grow to maintain the health of the whole tree. There is no need to cut the trunk or spend from the initial investment. From this healthy tree, more apples grow and provide fruit each year. The grantor may again pick them to give them away.

- Alternatively, the apples can be composted and add nutrients to the bottom of the tree. Adding the apples to the bottom as compost results in the same thing as adding some of the interest back to the endowment fund. This produces more interest (apples) for the next year.

- Provide some current mathematical examples of this investment and payout. Allow the young people to make calculations with real amounts and current interest rates on investments.

For example: The Apple Foundation invests an endowment worth $10 million in an account that earns an average of 7.5% annually. At the time of making annual grants, the $10 million is now worth $10,750,000. The endowment rules allow the foundation to use 5% of the endowment, or $537,500 in their grant budget. After granting this amount, the account now has a value of $10,212,500, up from the original balance and continuing to earn interest. Not all years produce 7.5% interest, but the balance is higher in good years so the foundation never has to touch the original amount.

Reflection:

- Why is it important to manage an endowment well so the principal is never touched?

- Why do think endowments have rules, such as how much may be used each year or how the money is spent?

- Whose job is it at the foundation to invest the endowment funds and manage the budgets? If possible, ask them to explain their work to the youth council.